How can we help you?

We are not just another credit card matching service. We have a passion for helping people stay out of debt and increase their financial well-being. Our expert team believes all consumers - even those with bad credit - must have access to not only leading credit products, but real-world, helpful advice as well. Obtain the financial assets you deserve with Credit Card Chest today!

Looking for anything in particular? Find your perfect fit, fast.

Offer of the Month

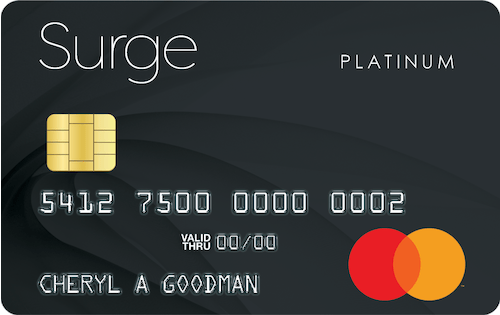

Surge Mastercard

Recommended Credit Score: Poor – Excellent

- Credit Limit between $300 and $1000

- All pre-qualified offers are based on creditworthiness

- Cardholders not held responsible for unauthorized charges

- Potential to increase credit line after 6 months of timely payments

- Report to all 3 major credit bureaus

FAQ

Do you know how to pick a credit card? What should you look for in a credit score monitoring service? Is a personal loan a good choice for you? If these questions sound familiar - you're not alone! Most people are unsure and end up with a financial product that doesn’t meet their needs. Luckily the Credit Card Chest experts put together some tips for choosing wisely below.

- Make timely payments on current debt. Even one missed payment can lower your score by 100 points.

- Keep your credit utilization ratio under 30% month-to-month. This means if you have a $1,000 credit limit, keep the open balance at $300 or less consistently.

- Think twice before closing old zero balance accounts. The longer you can show a favorable credit history, the better potential you have at approval.

- Don’t apply for multiple card all at once. Having back-to-back inquiries on your credit report can be a red flag for financial troubles.

- Keep an eye on your credit score. Review your credit score on a regular basis and immediately dispute any questionable changes.

Our Blog

How to Get Your Credit Card Limit Increased

If you’ve been following our blog for any time,...

Read MoreLearning to Read Your Credit Report

We’re sure you’re familiar with the saying, “you are what...

Read More